Charge vs Credit Cards

Most people don't know the difference between charge and credit cards and there aren't very many differences. There's just one key and critical difference: the ability to carry a balance.

With a credit card, you'll typically have the option of just making minimum payments and the carry the remaining balance into the following month. If you do this, you'll be paying a lot in interest so you're best off not carrying a balance. With a charge card, there is no interest rate as the balance HAS to be paid in full every month.

Most charge cards are issued by American Express and have no preset spending limit. Note that this does not mean no limit. It means there is an undisclosed limit. Spend over that undisclosed amount and your charge will be declined. American Express currently has 4 consumer charge cards: Platinum, Premier Rewards Gold, Gold, and Green. They used to have a fifth, the Zync, but this has been discontinued. 6 if you count the Centurion (Black card).

Chase used to offer a charge card, the Ink Bold, but this has also been discontinued. Both of their Ink products are credit cards.

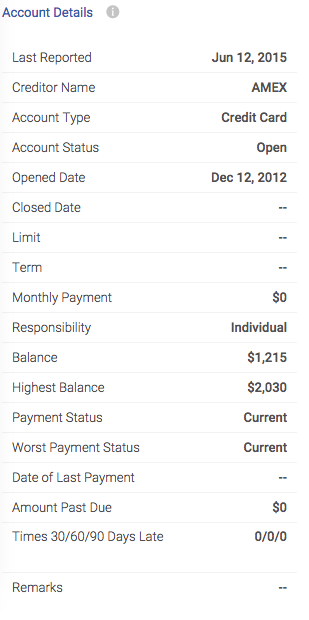

The second most notable difference is the way a charge card reports on your credit report. Charge cards DO NOT report a credit limit because there is supposedly no credit limit, just an internal, undisclosed limit. This effectively means if you have a more limited credit profile and not much total available credit, spending large sums on your charge card WILL adversely affect your credit. Below is how my American Express Platinum (left) and my Blue Cash (right) reports on my CreditKarma report.

Example 1:

If you only have 2 cards, one charge card and one credit card and on your credit card, you have a a credit limit of $10,000. You spend a total of $5,000 between both cards this month. This means your credit utilization, a very important component of your credit score, will be 50%. Ideally, you should keep your credit utilization under 20%. Usage of credit over 30% will adversely affect your credit as lenders see that as using too much of your available credit.

Example 2:

If you only have 2 cards, both credit cards and you have a limit of $6,000 on one card and $10,000 on your other card. This means you have a total available credit of $16,000 so if you spend $5,000 this month between both cards, your credit utilization will be 31.25%. This is still not ideal, but much better than 50%.

As you can see, because charge cards do not report a limit, if you charge large amounts each month, your credit will be negatively affected as you will be considered using a large chunk of your total available credit, even though you have no preset spending limit on your charge card.

However, for most people with an American Express Charge card, they will have many other credit cards and enough total available credit for spending on their Charge card to not hurt their score. Also note that ALL American Express charge cards have annual fees so unless you're more "experienced" to credit, you probably won't apply for a charge card. But if you are in the minority with credit cards with small limits and a charge card, be careful not to spend over 30% of your total available credit, ignoring the "no preset spending limit."